MSME Credit Growth Momentum Continues With Rising Demand And Stable Performance

CIOTechoutlook Team | Friday, 11 August 2023, 06:10 IST

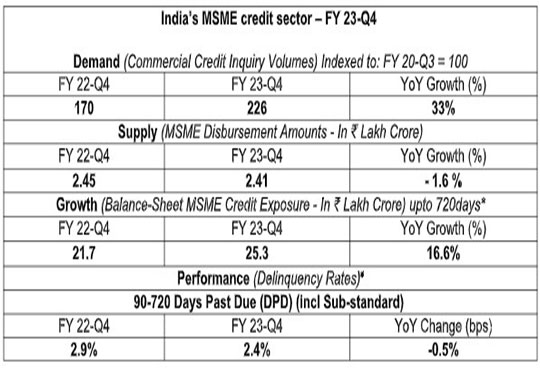

Insights from the latest edition of the TransUnion CIBIL-SIDBI MSME Pu- lse Report show that commercial credit growth momentum continues with portfolio balance growth of 15% year-over-year (YoY) in FY 23-Q4. Commercial credit exposure stood at INR 27.7 lakh crores in the quarter, which includes new originations of INR 241K crore. Insights show that commercial credit demand (measured in terms of credit inquiry volumes) is correlated to the improvement in business activity and grew by 33%, while credit supply volume grew by 11% YoY. Credit supply volumes in micro and small segments grew by 16% and 1% respectively, while the medium segment declined by 8%.

Insights from the latest edition of the TransUnion CIBIL-SIDBI MSME Pu- lse Report show that commercial credit growth momentum continues with portfolio balance growth of 15% year-over-year (YoY) in FY 23-Q4. Commercial credit exposure stood at INR 27.7 lakh crores in the quarter, which includes new originations of INR 241K crore. Insights show that commercial credit demand (measured in terms of credit inquiry volumes) is correlated to the improvement in business activity and grew by 33%, while credit supply volume grew by 11% YoY. Credit supply volumes in micro and small segments grew by 16% and 1% respectively, while the medium segment declined by 8%.

Speaking on the findings of this edition of the MSME Pulse, Mr. Sivasubramanian Ramann, Chairman and Managing Director, SIDBI, said: “The progressive reforms introduced by the government for the MSME sector resurgence have borne fruit as reflected in the vigorous business activity and improved credit uptake in micro and small segments. We would encourage the credit industry to duly support this increasing demand by providing timely access to credit opportunities for MSMEs, thereby contributing to the sustained growth of the sector and the economy to meet the government’s USD 5 trillion economy objective.”

Adding to this, the Managing Director and CEO of TransUnion CIBIL, Mr. Rajesh Kumar, said: “Bridging the demand-supply gap is a priority call-to-action for lenders. With rising demand, improved credit performance and promising economic growth prospects, the time is conducive for lenders to expand their MSME credit portfolios. India has approximately 630 lakh MSME corporates of which only 250 lakh have ever availed credit from formal sources. While the sector continues to grow at a projected compound annual growth rate (CAGR) of 2.5%, the number of MSME corporate entities is expected to touch 750 lakhs by FY23. Of these, around 500 lakhs are expected to be NTC MSMEs. Lenders can tap into this vast segment by identifying deserving NTC MSMEs, connecting with them and customizing credit products for their requirements.”

Exhibit 1. Mapping India’s MSME credit through the MSME Pulse lens

Delinquency rates have gradually declined over the last three years as MSMEs continued to serve their credit obligations well. In FY 23-Q4, delinquency rates dropped across all the three lender categories, public sector banks (PSBs) at 3.0%, non-banking financial companies (NBFCs) at 3.6% and with private banks being the lowest at 1.4%. NBFCs showcased the largest decline in delinquency rates at 3.6% in FY 23-Q4, down from 5.0% in FY 22-Q4.

Highest growth in ‘micro’-segment originations

Data from this edition of MSME Pulse shows that PSBs are leading the MSME loan originations in the ‘micro- segment. The micro-segment, where credit exposure is less than INR 1 crore, registered 23% YoY growth in originations value while the small segment, where credit exposure is between INR 1 crore to INR 10 crores, grew at 1%. However, originations value in the ‘medium’ segment, where credit exposure is between INR 10 crores to INR 50 crores, fell by 19% YoY.

State-by-state analysis shows that the rate of credit growth was highest in Uttar Pradesh, Karnataka, Telangana and Haryana, primarily driven by microloans. Amongst these four states, Karnataka exhibited the highest growth rate of 8% YoY. Credit supply by public sector banks to ‘micro-enterprises’ in Karnataka grew by 119% YoY.

Credit supply was highest in the industrialized states of Maharashtra, Gujarat and Tamil Nadu, which continued to hold the largest share in terms of origination value of MSME loans in FY 23-Q4.

New-to-credit (NTC) entities will be instrumental in defining the next phase of MSME credit growth

This edition of the MSME Pulse covers a study on NTC MSMEs and analyses the potential of this segment in catalyzing MSME credit growth. In FY 23-Q4, NTC borrowers accounted for 56% of new loan originations in the MSME lending space. Specifically, within the ‘micro’-segment (less than 100 lakhs), NTC borrowers contributed over 61% of originations. High credit demand within this micro-segment, coupled with positive lender sentiment, has propelled the growth of NTC borrowers, significantly contributing to greater financial inclusion.

More than 50% of NTC borrowers who availed of loans of less than INR 50 lakh began their journey with smaller-ticket size loans. The report also highlights that public sector banks have been the dominant lenders to NTC borrowers seeking less than INR 50 lakh loans, while private banks are the leading suppliers of loans between INR 50 lakh to 1 crore. NTC borrowers from rural and semi-urban areas availed of loans of ticket sizes less than INR 10 lakh. State-by-state analysis shows that Uttar Pradesh, Maharashtra and Karnataka have a steady growth pattern in NTC share with respect to origination as well as proportion.

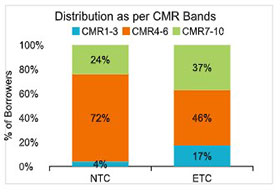

Further, the report includes a study based on CIBIL MSME Rank (CMR) to provide a comparative view of NTC and existing-to-credit (ETC) borrowers in the micro-segment. This analysis shows that 72% NTC borrowers are medium risk (CMR 4-6) while 46% ETC borrowers exist in the medium risk CMR range, where the CMR rank for NTC borrowers is measured after 6 months of originations.

The additional findings highlight that over the course of 18 months following their first credit loan origination, NTC MSMEs demonstrated remarkable credit growth, building balances that are 1.4 times higher compared to ETC entities. As the NTC consumers gain credit access, build history, and avail more lines of credit, they exhibit a faster rate of improvement than their ETC counterparts. This emphasizes the positive impact of credit access on the creditworthiness of NTC borrowers.

The additional findings highlight that over the course of 18 months following their first credit loan origination, NTC MSMEs demonstrated remarkable credit growth, building balances that are 1.4 times higher compared to ETC entities. As the NTC consumers gain credit access, build history, and avail more lines of credit, they exhibit a faster rate of improvement than their ETC counterparts. This emphasizes the positive impact of credit access on the creditworthiness of NTC borrowers.

With the rapid evolution of information infrastructure and technology, MSME credit underwriting has become information oriented, quicker, and more trustworthy. Credit institutions must astutely wield the power of data for identifying deserving NTC MSMEs and supply credit to them to scale sustainable growth.

Source : Press Release

CIO Viewpoint

BSE - Traversing the Cycle of Continuous...

By CIOReviewIndia Team

Enabling Financial Inclusion on a Digital Platform

By Manoj Kumar Nambiar, Managing Director and Arvind Murarka, Head IT at Arohan Financial Services (P) Limited

Key Tech Trends for Capital Markets

By Dipak Rout, Head-IT, ArihantCapital Markets Ltd

CXO Insights

By Supriyo Dasgupta, IT Applications Head, Compass Group India

The T Minus 10 Of AI - Getting Started with the...

By Sushil Kumar Tripathi, AVP - Technology, Kellton Tech

Digitization in Insurance Industry

.jpg)

.jpg)